A Practical Guide to Understanding NET 60 Payment Terms

NET 60 payment terms offer a 60-day window for clients to settle invoices, providing a balance between operational flexibility and financial strategy. This common business-to-business agreement can significantly impact cash flow management, offering buyers considerable breathing room to allocate resources while posing challenges for sellers in maintaining their own liquidity.

- Overview of NET 60 Payment:

- Clients have 60 days from the invoice date to pay.

- Provides a competitive edge by offering clients more time.

- Can strain seller cash flow, as revenue collection is delayed.

Understanding the nuances of NET 60 payment terms is crucial for any business seeking to optimize its cash flow strategy, particularly in mid-sized businesses that balance innovation and financial prudence. At Amplify Score, we specialize in providing custom website development, AI tools, and IT consulting services. Our deep expertise in NET 60 payment terms ensures businesses can maintain flexibility in operational and cash flow management as they grow.

Simple NET 60 payment glossary:

What is NET 60 Payment?

Definition

In simple terms, NET 60 payment is an agreement where the buyer must pay the seller within 60 days of receiving the invoice. This period starts from the date on the invoice, not from the date the goods or services are delivered.

Invoice Terms

When a business issues an invoice with NET 60 payment terms, it’s crucial to specify the start date clearly. This is usually the invoice date, but it can also be the date of delivery or receipt of goods, depending on the agreement. Clear documentation ensures everyone is on the same page, reducing the risk of misunderstandings.

Payment Period

The 60-day period offers buyers ample time to verify the invoice and manage their finances. This flexibility can be especially beneficial for businesses with seasonal cash flow variations or those waiting on payments from their own clients.

However, sellers need to prepare for this waiting period. It requires careful planning to ensure that their cash flow remains stable while awaiting payment.

By understanding and implementing NET 60 payment terms, businesses can provide flexibility to their clients while maintaining a strategic approach to cash flow management. This can lead to stronger business relationships and a competitive edge in the market.

How NET 60 Payment Terms Work

NET 60 payment terms are a common practice in business-to-business transactions, providing flexibility and opportunities for both buyers and sellers. Let’s explore how these terms function, focusing on trade credit, early payment discounts, and invoice factoring.

Trade Credit

Trade credit is the foundation of NET 60 payment terms. It allows buyers to receive goods or services immediately but pay for them later. This arrangement acts as a form of short-term financing and is usually extended based on the buyer’s creditworthiness. Suppliers often perform a credit check using business credit bureaus like Dun & Bradstreet before granting trade credit.

For new or smaller businesses, establishing a good credit history can be crucial to obtaining favorable terms like NET 60. Initially, they might only qualify for shorter terms like net 30, but as their credit standing improves, longer terms become accessible.

Early Payment Discounts

To encourage faster payments, suppliers might offer early payment discounts. For example, terms like 2/10 net 60 mean that if the buyer pays within 10 days, they receive a 2% discount. This can be a win-win: buyers save money, and sellers improve their cash flow.

These discounts, however, are optional. If the buyer chooses not to take the discount, they simply pay the full amount by the end of the 60-day period.

Invoice Factoring

Invoice factoring is a financial strategy that sellers use to maintain cash flow when offering longer payment terms. By selling their outstanding invoices to a factoring company, sellers receive immediate cash, reducing the financial strain of waiting for payments.

This method is particularly useful for businesses needing liquidity but wanting to offer competitive NET 60 terms. It allows them to provide flexible payment options without jeopardizing their own financial stability.

Understanding the mechanics of NET 60 payment terms can help businesses optimize their financial strategies, offering flexibility to clients while safeguarding their cash flow. This balance is essential for fostering long-term business relationships and achieving sustainable growth.

Pros and Cons of NET 60 Payment Terms

NET 60 payment terms can be a double-edged sword for businesses. They offer several benefits but also come with certain drawbacks. Let’s break down the pros and cons.

Pros

Cash Flow Flexibility

One of the biggest advantages of NET 60 payment terms is the cash flow flexibility they offer to buyers. With a 60-day window to settle invoices, businesses can better manage their finances. This extra time allows buyers to organize their resources, which can be crucial for those with tight budgets or cyclical income patterns.

Offering longer payment terms can set a business apart from its competitors. In markets where products or services are similar, flexible payment options like NET 60 can sway buyers’ decisions. This can lead to increased sales and customer loyalty.

Improved Trust and Relationships

Long payment terms can foster trust between business partners. By showing confidence in the buyer’s ability to pay, sellers can build stronger, more enduring partnerships. This goodwill can lead to repeat business and long-term collaborations.

Cons

Risk of Non-Payment

While NET 60 payment terms can attract more business, they also increase the risk of non-payment. The longer the payment period, the higher the chance of late or missed payments. This can lead to cash flow issues for the seller, especially if they rely on timely payments to cover their own expenses.

Administrative Burden

Managing NET 60 payment terms can be administratively demanding. Keeping track of invoices, payment deadlines, and follow-ups requires time and resources. This added workload can strain small businesses, diverting attention from other important tasks.

Cash Flow Challenges

For sellers, waiting 60 days for payment can lead to cash flow challenges. This delay might require them to use credit lines or loans to cover short-term expenses like payroll and rent. Such financial strain can be particularly tough on small businesses with limited working capital.

Navigating the pros and cons of NET 60 payment terms can help businesses make informed decisions about their invoicing strategies. Understanding these aspects is crucial for balancing customer satisfaction with financial stability.

Comparing NET 60 with Other Payment Terms

When it comes to payment terms, businesses have several options to choose from. Let’s explore how NET 60 payment terms stack up against other common terms like net 30, net 90, and payment in advance.

Net 30

Net 30 is one of the most commonly used payment terms. It allows buyers 30 days from the invoice date to make their payment. This shorter period compared to NET 60 can be beneficial for sellers who need quicker cash flow. However, for buyers, it offers less flexibility in managing their finances.

Example: A supplier might offer net 30 terms to a new customer to minimize risk while still providing some credit flexibility. This is often seen as a starting point for new business relationships.

Net 90

On the other end of the spectrum, Net 90 terms give buyers 90 days to pay. This extended period can be attractive to buyers who need more time to manage their cash flow. However, it can pose significant risks to sellers, as the longer payment period increases the chance of non-payment and can strain their cash flow.

Example: Larger corporations or businesses dealing with substantial orders might opt for net 90 terms, as they often have the financial stability to handle the delayed payment.

Payment in Advance

Payment in advance requires buyers to pay before receiving goods or services. While this eliminates the risk of non-payment for sellers, it can deter potential buyers who prefer some credit flexibility. This method is often used in high-risk transactions or when dealing with new, unverified customers.

Example: In industries like construction, where upfront costs are high, payment in advance is a common practice to secure funding for materials and labor.

Understanding the differences between these payment terms can help businesses choose the right option based on their cash flow needs and risk tolerance. Each term has its own set of advantages and challenges, and selecting the right one can make a significant impact on a company’s financial health.

Frequently Asked Questions about NET 60 Payment

What does net 60 mean on an invoice?

Net 60 on an invoice means the buyer has 60 days from the invoice date to pay the full amount. This timeline offers buyers a two-month window to manage their finances and settle the invoice. It’s important for businesses to clearly state the invoice date and payment due date on their invoices to avoid confusion. This ensures both parties are on the same page about when the payment is expected.

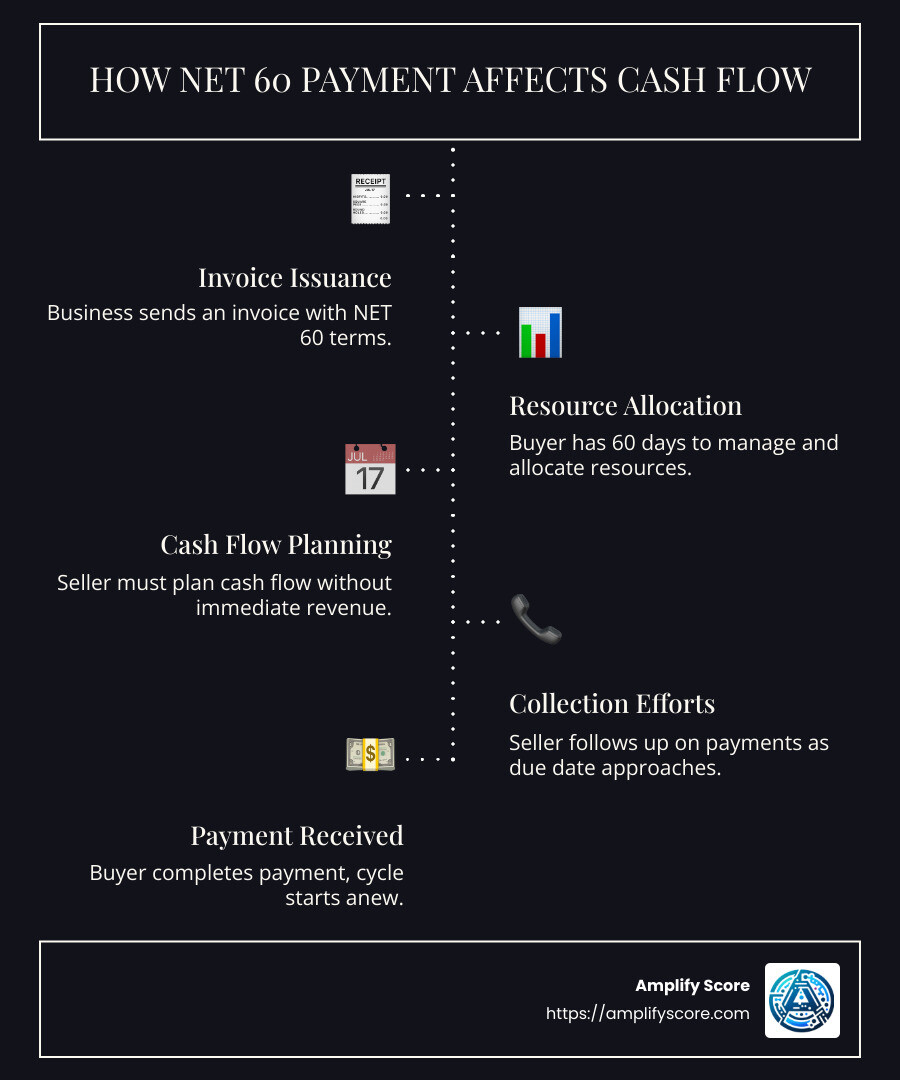

How does NET 60 affect cash flow?

NET 60 payment terms can significantly impact a company’s cash flow. For buyers, the extended period provides more time to manage their finances and plan their budget. This can be especially helpful for businesses dealing with seasonal fluctuations or waiting for payments from their own customers.

However, for sellers, waiting 60 days for payment can strain their cash flow. They may struggle to cover expenses or invest in growth during this period. Proper financial planning is crucial to mitigate this risk. Sellers need to ensure they have enough working capital to maintain operations while waiting for payments.

Can invoice factoring help with NET 60 terms?

Yes, invoice factoring can be a valuable tool for businesses dealing with NET 60 payment terms. It involves selling your unpaid invoices to a factoring company at a discount in exchange for immediate cash. This can greatly improve cash flow, allowing businesses to access funds tied up in invoices long before the payment is due.

By working with factoring companies, businesses can alleviate the cash flow constraints posed by extended payment terms. This enables them to cover expenses, invest in growth, and reduce the stress associated with waiting for payments. Factoring is a practical solution for maintaining liquidity and ensuring smooth financial operations.

Conclusion

At Amplify Score, we understand the importance of balancing flexibility and financial stability in today’s business environment. That’s why we offer custom solutions custom to meet the unique needs of each client. Our expertise in bespoke website design, AI tools, and IT consulting ensures that your business gets the right support to thrive.

One of our key offerings is flexible payment terms, including NET 60 payment options. These terms give your business the breathing room it needs to manage cash flow effectively. Whether you’re a small business or a larger enterprise, having 60 days to settle invoices can be a game-changer, allowing you to allocate resources strategically and maintain smooth operations.

By choosing Amplify Score, you’re not just opting for a service provider; you’re partnering with a team committed to your success. Our flexible payment terms are designed to support your growth and help you steer financial challenges with ease.

Explore our range of digital solutions and see how we can help your business succeed. Find our custom solutions here.